It was clear from the very beginning. Despite winning reelection on a message of ‘Axing Your Taxes,’ Governor Laura Kelly, a Democrat, was never planning to support meaningful tax relief for the people of Kansas.

On Monday, Gov. Kelly laid bare her tax-and-spend agenda by vetoing SB 169. A crowning achievement of the 2023 legislative session, this tax relief package would put nearly $500 million back into the pockets of hardworking Kansans every year, moving Kansas to a single-rate tax while delivering on Kelly’s own goal of accelerating the phase-out of the sales tax on food.

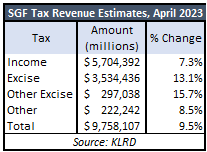

Kelly’s excuse is that a flat tax will break the budget, but it won’t. Kansas Legislative Research predicts a $3 billion surplus at the end of next year, and that is after the first year SB 169 is implemented. Spending can continue to grow at the same pace as tax receipts and still have a balanced budget.

This a much different circumstance than Governor Sam Brownback’s tax plan that was reversed in 2017. Everyone knew the tax bill signed in 2012 would break the budget within two years without relatively minor spending reductions, yet Brownback, the Democrats and some Republicans declined opportunities to cut waste and instead, they spent even more!

Kelly also says a flat tax isn’t fair and that it mostly benefits ‘the wealthy.’ It’s true that people with higher incomes save more money, but that’s because they pay most of the taxes. The most recent data from the Kansas Department of Revenue shows that people with adjusted gross income above $100,000 paid 70% of the total income tax with only 61% of total AGI, while those with less than $50,000 AGI had 17% of total income but paid only 9% of total state income tax. What is not ‘fair’ about that?

As the legislature returns to Topeka this week, the stakes could not be higher. Republicans in the House and Senate should embrace this golden opportunity to override the governor’s veto, reduce income taxes for all Kansan families and small businesses, and make the Kansas economy more competitive on the national stage.

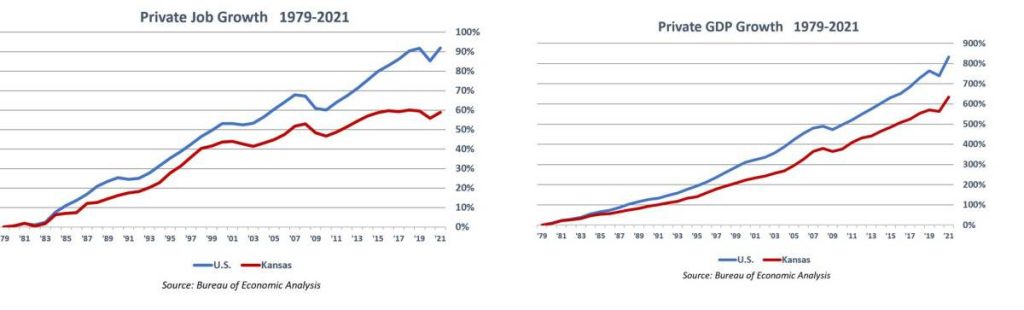

Kansas is in its fifth straight decade of economic stagnation, and it’s getting worse. The Sunflower State had the ninth-worst increase in private nonfarm earnings over the last three years and the seventh-worst increase in private-sector jobs since 1998.

Lowering income tax rates is a powerful way to spur population growth for years to come. The states without an income tax gained 7.4 million people from domestic migration this century while the income-taxing states lost 7.4 million, and that isn’t a weather thing. No one moves to South Dakota, New Hampshire or Wyoming for the warm winters.

Kansas is horribly uncompetitive on taxes. Its income tax rates are well above the national average; it has the ninth-highest sales taxes, the worst effective tax rate on mature businesses, and is the third-worst state for taxes on retirees. On top of all that, Kansan homeowners pay some of the highest property tax rates in the nation.

SB 169 provides relief in each of these areas. It would consolidate Kansas’ three tiers into a single bracket with a flat rate of 5.15% in a way that ensures all taxpayers get a break. While the original version of the bill cleared the Senate with an even lower 4.75% rate, this “compromise” package received overwhelming support in both chambers, including a vote of approval from Democrat Rep. Marvin Robinson.

SB 169 will also provide direct relief to thousands of small businesses, which file their taxes on the personal side of the code. And by simultaneously cutting the normal corporate income tax rate from 4% to 3%, SB 169 helps Kansas attract more investment from larger businesses, without the need for more carveouts and special exemptions.

Putting the Kansas proposal into context, even Democrat-controlled states like Illinois and Colorado already have a flat tax. Moreover, single-rate taxes have proven quite popular, even with liberal voters. For example, a 2020 ballot measure in Illinois would have replaced the 5% flat tax to allow for higher taxes on the rich. Strikingly, the same progressive voters that elected Joe Biden by a 17-point margin voted overwhelmingly to uphold the flat tax, 55%–45%.

Over the last decade, people and jobs have fled out of high tax states and into states that impose low- and no-income taxes. The flexibility to work remote is amplifying this trend. To compete for that investment, a growing movement of states are working to reduce and phase out their income taxes.

The last few years have seen a record number of states move to streamline their income taxes to a flat rate and put them on the path to zero. In the 2021 and 2022 legislative sessions, five states – Idaho, Georgia, Mississippi, Arizona, and Iowa – exchanged their progressive income tax system for a single-rate tax. That brought the total number of flat tax states to 13.

Meanwhile, there are a total of eight states that do not impose individual income taxes on earnings. This trend is picking up steam in 2023. More than a dozen states – including North Carolina, Mississippi, Iowa, Louisiana, Oklahoma and Kentucky – are jockeying to be the next state added to the “no income tax” list. Doing nothing may cause Kansas to fall behind.

Grover Norquist is President of Americans for Tax Reform. Dave Trabert is CEO of Kansas Policy Institute.