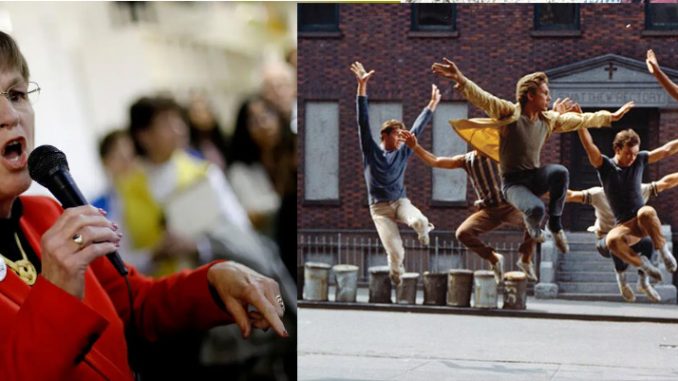

Governor Laura Kelly is ready to go all Sharks and Jets on any recession that may come knocking on Sunflower State turf – jonesing for a rumble just like Riff and Bernardo in “West Side Story” – and backed up by tons of surplus cash that came out of your pockets from Kansas’ ever exorbitant tax rates.

“Bring it on,” she challenged recession fears last week while appearing before an audience of supporters. “Because we now have enough money to be able to ride it out, still funding everything that we’re supposed to be funding,” Kelly said.

No doubt we’re all bolstered knowing the grand architect of the Kansas pandemic shutdown, who shuddered small businesses and churches, stopped the economy and would probably still have you in a mask and some phase of “reopening” if not for Republicans in the Legislature, is ready to put up her dukes with your tax money if a recession gets lippy. How nice that Kansas’ coffers are so flush with our tax revenues, while folks hauling their kids to traveling team ball games this summer are shelling out nearly $5 a gallon for gas.

That Kelly would even mention “the R word” at all is a stark admission for a Democrat in public office right now. The frighteningly befuddled Joe Biden jumped a reporter just last month for suggesting a recession was heading our way, like the finger snapping chorus line of “Jet Song” in the 1961 version of WSS, saying he had recently talked to former treasury secretary Larry Summers and “there’s nothing inevitable about a recession.”

Trouble is, Summers was on an NBC news show just the previous Sunday saying a recession was likely, due to spiking inflation, like in previous history. Nonetheless Democrats dodge the mention of the word as they whistle past the graveyard as they tow the ridiculous party line. But hey, “when you’re a Jet you’re a Jet all the way, from your first cigarette to your last dyin’ day.”

If you’re just a Kansan who’s been trying to put gas in your car or buy a steak or shingles for your roof or anything else this summer, Kelly’s comments are more than a little galling. If the state is so flush with extra cash – why not cut taxes and put a little of that windfall cash back in our pockets?

Of course this is coming from the Governor, who, flanked by economic development boy wonder David Toland earlier this spring took credit for every tax-generating private business investment made by real entreprenurs in the state over the past year. To hear Kelly and Toland tell it, it’s almost as if the less-than-dynamic duo had both cashed in their own 401k’s, mowed that weedy lot out back and helped pour the concrete for a new quiche and crab legs stand all by themselves.

Meanwhile, tax increases passed in 2015 and 2017 continue to drain the wallets of those earning a living here. And don’t forget – for those who were due a tax refund from the state back when Trump rewrote the federal tax codes as part of a national economic plan that actually worked – Kelly saw fit to keep the refund that should have come back to you.

Since then, though unemployment percentages make the state look fabulous, 38,000 fewer Kansans were working in May of this year compared to January 2020. In addition to job loss and crippling inflation, Kansans are paying some of the highest tax rates in the U.S. :

• our top marginal income tax rate of 5.7% is higher than 28 states.

• Kansas has the highest effective tax rate on mature businesses.

• the combined state and local sales tax rate is the ninth-highest in the nation.

“And of course Kansans pay some of the highest effective property tax rates in the country. We all saw what happened to our property valuations recently, and we’re all spooked about what unchecked local tax levies will do when applied to the assessments on those higher, inflation-driven values as cities and counties and school districts draft their 2023 budgets.

Instead of claiming credit for the success due private business investors and talking smack about how much extra cash the state has drained from the citizenry as 40-year record inflation chews away at every Kansas household, Kelly should have spent the post-Covid recovery coming up with a plan to cut personal and corporate income taxes and leave that windfall with the people who earned it. ###

–Dane Hicks is publisher of The Anderson County Review in Garnett, Ks.